Because of the COVID-19 Pandemic, many have had their income severely reduced, making it hard to keep up with mortgage payments. The federal government has created loan forbearance plans which may help ease the burden for many homeowners. However, be careful…it may not be the best option for everyone, especially given that not all of the details have been hammered out. In this video, Rob Berg with Fairway Home Loans shares his perspective and caveats, offering food for thought if you’re considering the loan forbearance option.

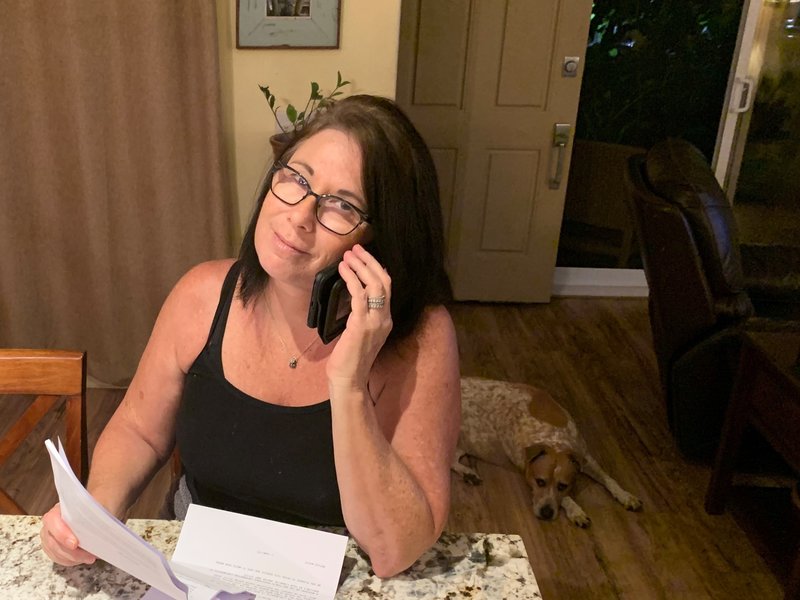

Julia Hansen talked with her lender, Freedom Mortgage, who told her that in order to get federally mandated help, she was required to make an $8,000 payment in three months or else “go into foreclosure.” Photo courtesy of Peter Hansen Also See NPR article, https://www.npr.org/2020/04/07/828011892/many-struggling-homeowners-not-getting-the-mortgage-relief-u-s-promised

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link