As we finish 2022, in North King and South Snohomish counties, at the end of November the median sold price went up 2.5% from one year ago but down 14.4% from its high of $900k in March of this year. Price fluctuations vary from neighborhood to neighborhood, at different price points, and depending on the type of property. Why did prices drop this year? Quite simply, interest rates. Roughly 75% of buyers purchase a home using financing. This means they purchase what they can afford based on their monthly payment. Increasing interest rates cause buyers’ monthly payments to increase, making the price of the home they can afford to decrease. Increased rates coupled with decreased demand (from thousands of buyers waiting for rates to go down), has pushed prices down.

More on interest rates, since they have been the driving factor in our real estate market this year: In the first week of 2021 we saw the lowest rates in Freddie Mac’s history: 2.66% for a 30 year fixed-rate loan (see graph HERE). A year ago on 12/23/2021 the 30-year fixed rate was 3.05%. In March 2022, the Fed started to sharply raise short-term interest rates to slow inflation. From March to June 2022, mortgage rates went up over 2%. By November 10, they hit this year’s high of 7.08%.

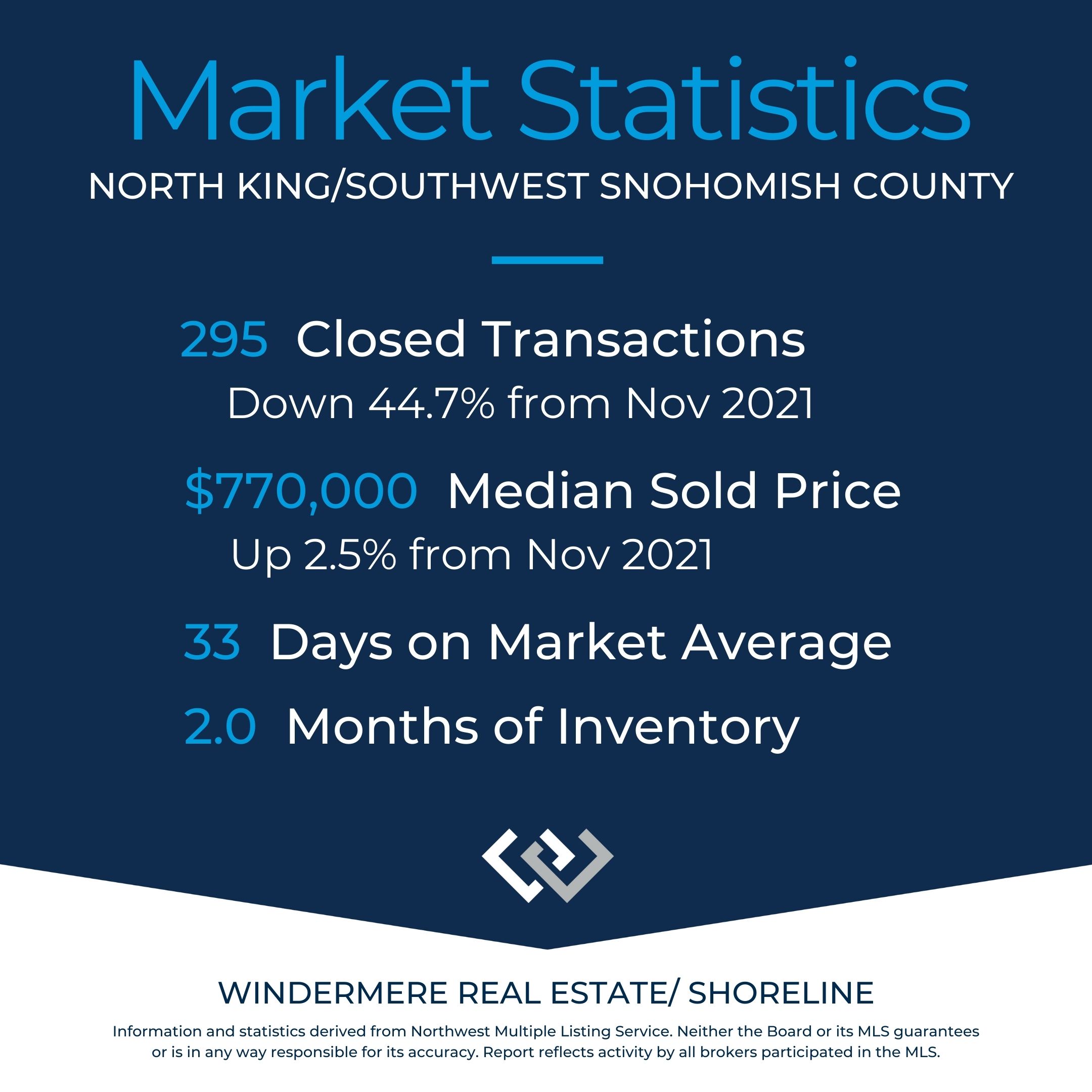

The Fed’s rate hikes appear to be working and inflation is slowing. Mortgage rates have come down slightly from their high in early November, which has slightly boosted buyer demand recently even during our seasonal slowdown. Inventory is at its lowest this time of year mostly due to seasonality. However, there are fewer home sales compared to last year: 44.7% fewer in November 2022 compared to November 2021. This can be attributed to a lot of buyers pausing and waiting for rates to drop. Lower demand means properties are sitting on the market for longer, 33 days on average compared to 12 days at the same time last November. Inventory now sits at 2%, creating an almost “balanced” market (depending on who you talk to).

Other thoughts on rates…the rapid drop in sales prices since mid-year has caused some to say we say we are in a housing “bubble.” I disagree, and instead argue that we are experiencing a much needed correction and rebalancing. The rapid spike in prices over the pandemic (over 40% appreciation in two years) was caused by governmental support of the economy, including unnaturally low interest rates and government stimulus payments. Those ultra low rates acted like jet fuel to price appreciation, especially when combined with high demand, particularly from pandemic-driven moves. Our recent drop in housing prices should not cause alarm, because they were caused by short-lived, atypical factors. It reminds me of the price of lettuce which recently spiked to $6.99 a head at my local Thriftway. When the price drops 50% to $3 per head, I doubt people will panic and say we are experience a lettuce “bubble.”

Going forward into 2023, experts differ on what to expect. Matthew Gardner, Windermere’s Chief Economist, predicts in 2023 mortgage interest rates will settle in the mid 5’s. The National Association of Realtors (NAR) predicts “home prices will remain steady, sales will drop, and mortgage rates will settle in at less than 6%.”1 Historically 5% interest rates are still very good, as this is roughly two percentage points below the historical average and nowhere near the 18.39% high in October 1981. As 2023 evolves, my sense is buyers (and sellers) will likely get used to rates in the 5 and 6% range. People will buy and sell more again compared to the second half of 2022, but less than during the pandemic. Many experts predict fewer home sales this next year especially as homeowners with 2-3% mortgages stay put. Moving and getting less house for the same or more amount of money doesn’t make sense for a lot of people. For those who choose to buy and sell this next year, life changes (death, divorce, changing family size) will play a bigger part than in years past. As I like to tell people, real estate happens when life happens.

Final thoughts: As Martha Stewart would say, the balancing of our real estate market is a good thing. Will it become a buyers’ market any time soon? Probably not, mostly because we have a chronic undersupply of houses which will likely worsen. Simply stated, we are not building houses fast enough, particularly as millions of Millennial and now Gen Z buyers enter the housing market looking to purchase their American Dream. As with our lettuce example, low supply without a corresponding drop in demand puts upward pressure on prices. Over time, I suspect single family homes will become harder and harder to purchase, pushing prices up again and causing people to start looking more seriously at condos. Regarding housing demand, it could heat up again in the coming year, especially if the millions of buyers currently waiting on the sidelines all of a sudden jump back into the market wanting to buy. We shall see…

TO READ MORE…

For Matthew’s Top 10 Predictions for 2023, click HERE.

To read NAR’s predictions for 2023, click HERE.

More mortgage lending predictions from Seattle Agent Magazine.

- As quoted in Seattle Agent Magazine, https://seattleagentmagazine.com/2022/12/13/home-prices-stable-national-association-of-realtors/?utm_source=emailoctopus&utm_medium=email&utm_campaign=12.19%20SEA-AU, accessed 12/23/2022.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link